HK's Rates reforms: damage to property values, needless complexity and misdirected handouts

30 January 2024

Background

The property Rates system (Rates) in HK has a long history dating back to the first Rating Ordinance of 1845, just 4 years after the British occupation. Back then, the purpose of Rates was to fund the Police Force. Subsequent Rates were used to fund street lighting (1856), water (1860) and the fire brigade (1875). All good stuff. Since 1931, income from rates has been part of the General Revenue account. A good history of all this is contained in the online books of the Rating and Valuation Department (RVD): The History of Rates in Hong Kong (2013) and the more recent Property Rates in Hong Kong (2021).

The Rates system relies on the concept of "rateable value" (RV), which is basically the estimated annual market rental value of a property on a given date, regardless of whether it is occupied by the owner, rented out or vacant. Originally, there were long periods between revaluations leading to sharp jumps when they took effect, but from 1988 this was reduced to 3-yearly, and since 1999, annually. The total RV of all properties at 1-Apr-2023 was HK$694.1bn.

Rates are then charged as a percentage of the RV. Since annual valuations took effect on 1-Apr-1999, the percentage has remained at a simple 5%.

Historic abuse of the Rates system

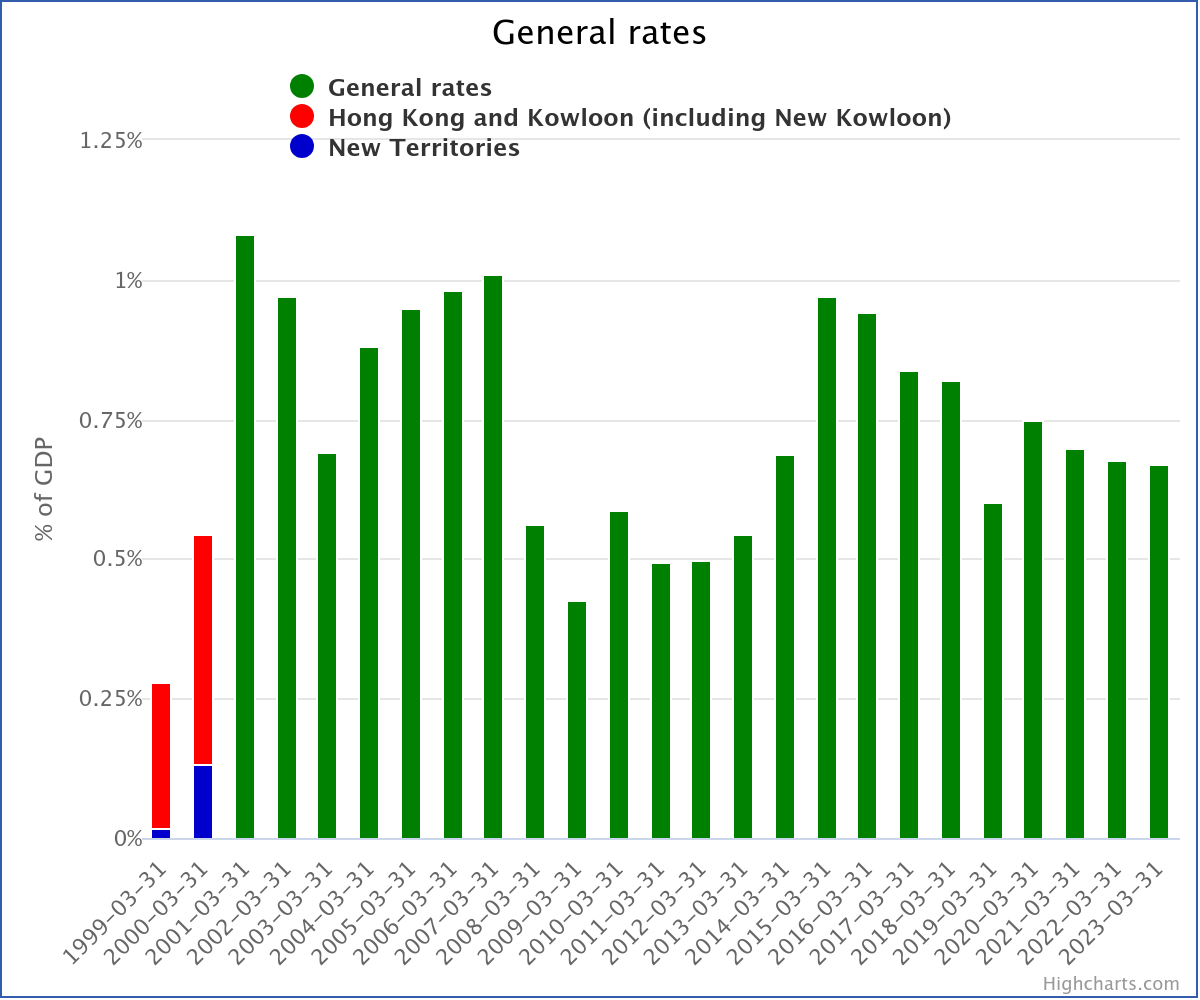

You might think, from the background above, that the Rates system produces a reliable, stable revenue stream for the Government, relative to economic activity which is reflected in RVs. However, a look at the General rates in the Webb-site HKSAR Accounts Explorer reveals a different picture, with rates as a percentage of Gross Domestic Product having fallen from 1.08% in the year to 31-Mar-2001, to 0.67% in the year to 31-Mar-2023.

The reason for this volatility is that, after an initial rebate (all rates for the quarter to 30-Jun-1998) and concession (half of all rates in the quarter to 30-Sep-1999) during the Asian Financial Crisis of 1998-99, in 2002-03 the Government began to abuse the Rates system as a sort of populist handout system, by capping concessions at a dollar amount ($5,000 in 2002). This of course favours properties with smaller RVs, while larger premises paid the normal 5% minus $5,000.

This was followed in the quarter to 30-Sep-2003 (the year of SARS) by differential concessions capped at $1,250 for residential properties and $5,000 for non-residential (which tend to have larger RVs). There was then a short 4-year period of fiscal sanity until the so-called "one-off concessions" began again in the year to 31-Mar-2008 and they have never stopped since. In the current year to 31-Mar-2024, for each of the first 2 quarters there was a concession capped at $1,000 per property (of all types), reducing revenue by HK$5.94bn.

Tinkering with capped Rates concessions, or capped waivers of salaries tax or profits tax, is not a sensible way to run the budget nor to conduct welfare. If the Government is raising too much revenue, which has been a problem in the past, then the solution is to cut the percentage rates of taxes, including Rates, or at least make a uniform concession as they did with Rates in 1998 and 1999, without caps. Everyone ends up paying the same lower percentage.

On the other hand, if the Government wants to do more to help the poor, as it should, then it should do so with means-tested payments via the Social Welfare Department. After all, genuinely poor people don't own property and therefor won't benefit from rates concessions anyway. Yes, there is a small category of people who own their home but are illiquid, but the solution for them is to sell the property and rent an equivalent one, not for the Government to compensate them for owning property and exclude those who don't own property from the embedded handout.

The proposed changes

Now, things are about to get worse, unless the Government rethinks. In the 2022-23 budget, Paul Chan Mo Po, the Financial Secretary, announced that the Government would:

- Further complicate the concessions for domestic (but not other) properties by limiting them to human owners (not companies), and only one property per owner (Phase 1).

- Introduce a "progressive" (a euphemism for "escalating") Rates system for domestic (but not other) properties by charging 5% on the first $550k of RV ($45.8k per month) of RV, then 8% on the next $250k, then 12% on the excess above $800k ($66.7k per month) (Phase 2). How they came up with these increments and thresholds, and how they might change in future, is anyone's guess.

The timing of these changes depends on necessary software and systems updates (at a cost of hundreds of millions of HK$), but could take effect in the coming fiscal year to 31-Mar-2025.

Phase 1

While reducing the number of properties entitled to a Rates concession would obviously increase revenue, the right question, as noted above, is "why even provide concessions at all"? Why introduce so much complexity when HK is supposed to have a "low, simple and competitive tax system"? This proposal entails development of a new system by RVD, extensive rewriting of its computer software, and sucking in data from the Land Registry and the Immigration Department to verify that the ratepayer is indeed the owner, that her HKID is correct, and that she is entitled to the concession. There will also need to be a system for deciding, if a person owns more than 1 domestic property, which one of those properties gets the Rates discount.

Phase 1 also emphasises the welfare nature of the concessions: the Government claims that it is unfair that "owners who hold multiple properties enjoy multiple relief" - even though they of course pay their fair share of taxes on every property. In essence, Phase 1 says "this isn't meant to be a tax reduction, it's a handout limited to 1 per human property owner". Strangely, though, this twisted logic is not being applied to non-residential properties such as shops and offices, which will continue to get 1 concession per property, regardless of the type of owner, if and when provided.

Phase 2

Phase 2 means that for a property with a RV of $800k ($66.7k per month), the tax would be $47.5k (5.94%), while for a property with a RV of $1.2m ($100k per month), the tax would be $95.5k, an effective rate of 7.96%. Obviously as RV rises, you get closer to the full 12%. A house with an RV of $2.4m ($200k per month) would cost 9.98% in rates - call it 10%. Here's the graph.

Impact of Phase 2 on valuations

Of course, the gross RV of a property is not the bottom line, because the owner has to pay for repairs and other outgoings (including in many cases, land rent at 3% of RV), so a change of 1% in the rate of Rates reduces net rental income by more like 1.2%. Ultimately, the value of a property equates to the net present value of its future net rental income. So for each additional 1% of RV (1.2% of net rental income) that the Government takes indefinitely, the value of your property should decrease by the same amount, 1.2%.

If you don't believe this, then imagine that the Rates were charged at 80% of RV and that your repairs and other outgoings were 20%. That would leave you with nothing every year, and the net present value of nothing is (approximately) nothing. The property would not just be worth less, but worthless.

And no, tenants will not pay more to rent your property just because your Rates have gone up. Their ability to pay depends on their incomes, not your costs. Any increase in rates comes out of the owner's pocket. Also, if the tenant pays the rates, then they will have less to spend on rent. So owners of a property with an RV of $100k per month will pay Rates of about 8% of RV versus the previous 5%. The effective 3.6% decrease in net rental income will reduce the value of that property by about 3.6%.

Phase 2 also involves new software for the RVD to calculate the Rates payable. The Government estimates that Phase 2 will raise an additional HK$0.76bn of revenue per year, a tiny amount relative to the $5.2bn cost of concessions on domestic properties in 2023-24. That's because it would only affect an initial 2.2% of domestic tenements (excluding separate car park spaces). But before you look away thinking that this won't affect you, consider the fact that once such a system is established, it is a relatively simple matter to steepen the curve with higher rates and to reduce the thresholds at which those rates apply. Even if the Government never changes the thresholds again, inflation will ensure that more properties are lifted into the higher bands.

The Government is, in our view, practicing the populist politics of petty envy while needlessly complicating what was a very simple system, particularly when it was a steady 5% without concessions. In its submission to LegCo on 14-Mar-2022, the Government admitted that:

"the existing regime to a certain extent already aligns with the "affordable users pay" principle by collecting more rates revenue in absolute amount from more valuable properties."

That should be enough, but they say that Phase 2 is to:

"further uphold the "affordable users pay" principle"

Where does this line of perverted reasoning take us? Would a 17% band be OK on top of the 5%, 8% and 12% bands? How about 28%? Surely that's affordable too, and it's a lucky number, unless you own a residential property.

It isn't too late to stop this madness. The Financial Secretary is shortly to announce his 2024-25 budget. Legislators, particularly those who own property, may wish him to think again. All that HK needs is a simple fixed percentage level of Rates on all properties, set according to revenue needs (currently 5%), without embedded and misdirected handouts.

© Webb-site.com, 2024

Organisations in this story

People in this story

Topics in this story

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy